When it comes to taxes, most people think of predictable levies like income or sales tax. But throughout history, governments have introduced some truly bizarre and creative taxes. Whether aimed at influencing behaviour, raising funds, or simply reflecting the quirks of the time, these taxes are bound to make you laugh, groan, or wonder how anyone came up with them. Here are 13 of the most absurd taxes ever imposed, showing the lighter side of a serious topic.

1. Window Tax – England

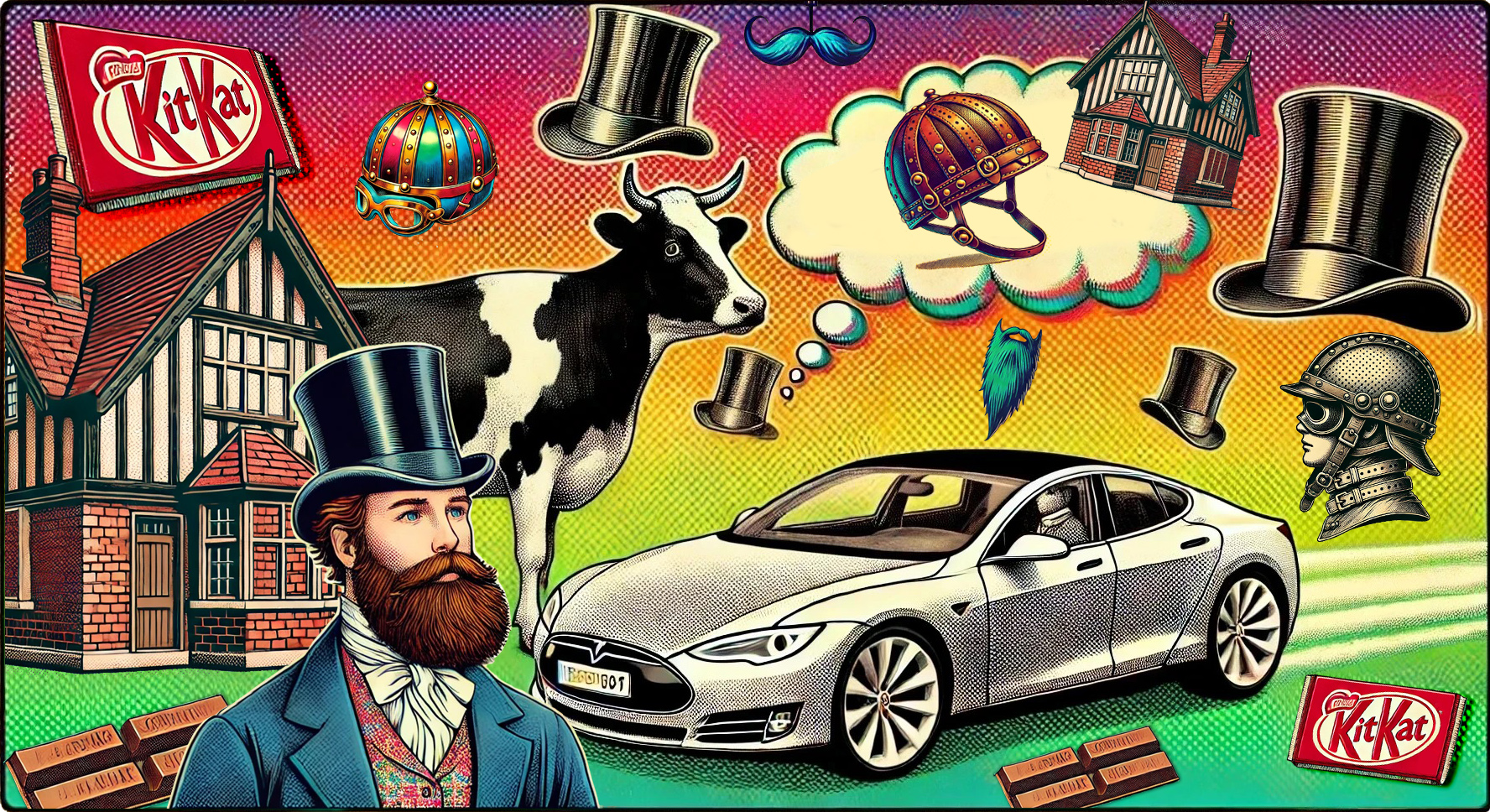

In 1696, the English government introduced a tax on windows, believing it was a fair way to estimate wealth. Wealthier households with bigger homes naturally had more windows, and the authorities thought this would generate revenue without directly taxing income.

The plan backfired spectacularly. Homeowners began bricking up their windows to avoid the tax, plunging rooms into darkness and reducing ventilation. The health consequences were serious, and the tax became so unpopular it was repealed in 1851. Today, many older buildings in England still have bricked-up windows as a quirky reminder of this odd policy.

2. Beard Tax – Russia

In 1698, Tsar Peter the Great decided that beards were out of fashion. To encourage his subjects to adopt the clean-shaven look popular in Europe, he introduced a beard tax. Men who wanted to keep their facial hair had to pay a fee and carry a token to prove they had paid. Those who refused could have their beards shaved off in public.

The tax wasn’t just about looks—it was Tsar Peter’s way of nudging his people toward modernisation. Beards had long been associated with traditional values, so this tax didn’t sit well with everyone. Still, it’s a prime example of how far authorities can go to push a style trend.

3. Hat Tax – England

In 1784, England introduced a tax on hats, with rates varying based on the hat’s material and style. Wealthier individuals with fancier hats naturally paid more, while clever citizens began inventing headgear that didn’t technically qualify as hats.

The tax led to some truly bizarre fashion trends and was eventually repealed. It’s a lighthearted example of how far people will go to outsmart tax laws—and keep their style intact.

4. Urine Tax – Ancient Rome

It’s not every day you hear about a tax on urine, but that’s exactly what Emperor Vespasian of Rome introduced. Urine was collected and sold for industrial purposes, such as tanning leather and laundering clothes. Recognising its value, the emperor decided it should be taxed.

The idea may sound absurd, but it worked. When questioned about the morality of the tax, Vespasian famously said, “Money doesn’t stink.” This phrase has lived on through the centuries, proving that even the strangest tax policies can leave a lasting legacy.

5. Bachelor Tax – Missouri, USA

In the 1820s, Missouri imposed a tax on unmarried men aged 21 to 50. Authorities believed this would encourage marriage and family life, which they saw as a cornerstone of society.

Instead of fostering romance, the tax sparked frustration. Single men were unimpressed by the government meddling in their personal lives, and the tax became a source of resentment. It’s proof that trying to legislate relationships rarely works as intended.

6. Playing Card Tax – England

In 16th-century England, playing cards were considered a luxury, so authorities decided to tax them. To enforce this, decks had to carry a government-issued seal, adding to their cost.

The tax was so high that it led to widespread counterfeiting, with underground markets churning out fake decks. Instead of boosting revenue, the tax inspired a wave of illegal activity. This is a classic example of how overtaxing can create more problems than it solves.

7. Cow Flatulence Tax – Denmark

Denmark has announced plans for a tax on methane emissions from livestock, popularly dubbed the “cow fart tax.” The proposed tax aims to tackle agricultural greenhouse gases and could make Denmark the first country to put a price on bovine burps and farts. While it’s set to take effect in 2030, some wonder if this policy will really take off or remain a case of hot air.

While well-meaning, the policy was heavily criticised for being impractical and costly to farmers. It also sparked plenty of jokes about the logistics of measuring a cow’s emissions. Despite the humour, it highlighted the serious challenge of balancing environmental goals with economic realities.

8. Chopstick Tax – China

In an effort to protect its forests, China introduced a tax on disposable wooden chopsticks. The idea was to reduce deforestation by encouraging people to switch to reusable utensils.

The tax sparked mixed reactions, as chopsticks are an integral part of Chinese dining culture. While some applauded the environmental focus, others found it an inconvenient way to tackle a global issue. Either way, it’s a reminder that even everyday items can become targets for creative taxation.

9. Luxury Car Tax – Australia

Australia’s Luxury Car Tax (LCT) is applied to vehicles priced above certain thresholds—around $91,000 for fuel-efficient cars and $80,000 for others. Introduced in 2000, the tax was initially designed to protect Australia’s local car manufacturing industry by making imported luxury vehicles more expensive. However, with no major car manufacturers operating in Australia today, many argue the tax has outlived its purpose.

Critics argue that the LCT often targets modern, efficient, and safe vehicles, which naturally cost more due to advanced technologies rather than excessive luxury. For example, some electric vehicles and family SUVs can unintentionally fall into the “luxury” category, leaving buyers frustrated. The LCT remains a contentious policy, with growing calls to reconsider its relevance in today’s automotive landscape.

10. Candy Tax – Illinois, USA

Illinois introduced a quirky tax that treats candy differently depending on its ingredients. If a candy contains flour, like a Kit Kat, it’s classified as a grocery item and taxed at a lower rate. If it doesn’t, like a Snickers, it’s considered candy and subject to a higher tax. This odd distinction stems from the state’s tax laws, which aim to separate “essential” groceries from luxury treats.

The reasoning was to avoid heavily taxing everyday food staples while generating revenue from non-essential sweets. However, the result has been more confusion than clarity, leaving shoppers wondering why some chocolate bars are cheaper than others. It’s a sugary example of how a simple policy can create a sticky situation.

11. Airbnb Tax – Victoria, Australia

In a move to address housing shortages, the Victorian government has legislated a 7.5% tax on short-term rental platforms like Airbnb, set to commence on January 1, 2025. The revenue, projected to reach $60 million annually, is earmarked for affordable housing programs, with a portion allocated to regional areas.

Critics, however, view this as a cash grab wrapped in good intentions. Landlords may be discouraged from offering short-term rentals due to the additional financial burden, potentially leading to higher holiday rental costs. This could impact tourists and families seeking affordable vacation options. Whether this policy effectively addresses housing issues or complicates tourism and rental affordability remains a point of contention.

12. Car Ownership Taxes – Singapore

Singapore has one of the world’s most expensive car ownership systems. Taxes, such as the Certificate of Entitlement (COE), can cost as much as the vehicle itself, making car ownership a luxury.

While the policy successfully reduces traffic and pollution, it’s a stark example of how taxes can drastically alter lifestyles. For many Singaporeans, public transport is the only practical option, turning cars into status symbols.

13. Fat Tax – Denmark

Denmark introduced a tax on foods high in saturated fats to promote healthier eating. While the intention was good, the tax was widely criticised for being inconvenient and unfair, especially for lower-income families.

After just one year, the tax was repealed, but it remains a memorable example of how even well-meaning policies can miss the mark. It’s a reminder that balancing health initiatives with practicality is easier said than done.

The Power of Taxes: Influencing How We Live, Work, and Play

Taxes are more than just a source of revenue—they shape our lifestyles, influence what we buy, and even affect how we behave. From fashion to food, governments have used taxes to nudge behaviours, encourage certain choices, or discourage others, often with unexpected or negative consequences. These quirky examples remind us that while taxes are inevitable, they can also leave a lasting impact—or even become the punchline of history’s oddest decisions. So the next time you pay a tax, just be glad it’s not on your beard or the number of windows in your home!

Tax laws vary widely, and while some may seem unusual or unexpected, they all require compliance from individuals and businesses, with failure to do so potentially resulting in penalties or legal consequences. If you have questions or need assistance navigating the complexities of tax regulations, contact us today. Our team is here to provide expert guidance and ensure you are well-prepared for any tax situation.